I cannot remember an election when taxes have not been an issue. Prior to every election we get pelted with the same crap. The Republicans will parade themselves around as the Party of fiscal responsibility, even though they have proven, time and time again, that they are not. Their mantra is they will cut taxes (for whom–they will not say); improve education and highways, yada, yada, yada; tell us Democrats support the boogeyman and will spend us into oblivion.

I cannot remember an election when taxes have not been an issue. Prior to every election we get pelted with the same crap. The Republicans will parade themselves around as the Party of fiscal responsibility, even though they have proven, time and time again, that they are not. Their mantra is they will cut taxes (for whom–they will not say); improve education and highways, yada, yada, yada; tell us Democrats support the boogeyman and will spend us into oblivion.

The Democrats are “for the working people,” except when, mysteriously, they “don’t have the votes.” That’s because the Republicans will not cooperate (not to mention their own party members who desert them on critical votes.) In Illinois the boogeyman is Mike Madigan, a Democrat. He must be the most hated Democrat in the State. Without him, the GOP would have nothing to whine about. He represents the 22nd House District in southwest Chicago. His constituents elected him in 1971 and every election since. He has served longer than any other elected State and Federal official. Madigan was elected Speaker by the House Democrats in1983 and has held this position ever since, except for two years when the GOP gained control of the House.

So, why is he the boogeyman?

It is easy to play the divide-and-conquer game. Politicians have been doing it since time immemorial. Chicago is bad; the rest of the State is good. Chicago gets everything; Down State gets the crumbs. Except, this is simply not true. Nineteen of the most southern counties get way more money from Springfield than they send to Springfield. Counties around Chicago get far less, while the rest of us break even. However, the myth that Chicago gets everything makes Madigan an easy target.

The real reason Governor Rauner has keen dislike for Speaker Madigan is, because Madigan has blocked Rauner’s agenda to make Illinois a “Right to Work” state. Rauner’s program for Illinois was a carbon copy of GOP Wisconsin Governor Scott Walker.

Speaker Madigan wanted to extend the temporary raise in the State’s flat rate income tax of 5% (introduced by Governor Pat Quinn), in order to pay the State’s bills. Governor Rauner vetoed the bill, causing the tax to return 3.75%. Personally that saved the Governor and his wealthy friends hundreds of thousands of dollars. If you paid State income tax on $20,000, it saved you $250 on your State income tax.

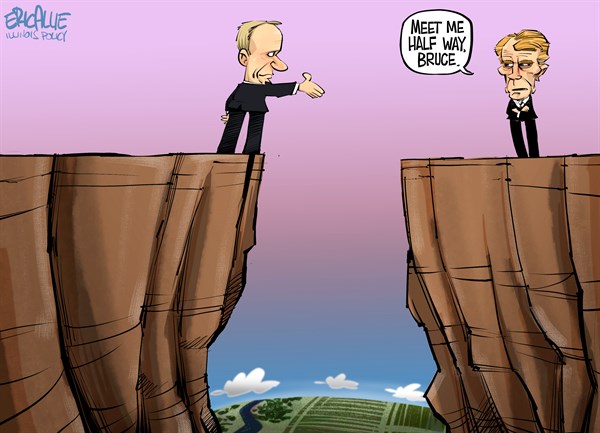

Speaker Madigan and Senate President Cullerton passed a budget for Illinois. Governor Rauner vetoed it for lack of money. Of course, there was not enough money; he had vetoed extending the 5% rate! So, the State went three years without a budget. Funding for education, mental health, etc., got cut to the bone, and the State became deeper in debt. Thus, Rauner and his GOP cohorts prefer to campaign against Speaker Madigan.

Question: “Who is the bad guy here?”

The guy who tried to protect worker rights, and to fund education and mental health? or the Governor who vetoed the money to pay for it? Most politicians claim they can do all these wonderful things by cutting waste. What they will not do is cite the specific waste. That is not to say there is none. Perhaps the State is paying too much for some rented office space. That would be wasted money. Perhaps giving tax write-offs to corporations is wasted money. However, under-funding our schools, mental health, and road maintenance can be more costly down the bumpy road.

Governor Rauner insists that Illinois taxes are too high and cutting taxes would create more jobs and improve the State’s economy. Kansas Governor Brownback tried this recipe with disastrous results. If you want good paying jobs for your State, you have to have a highly-skilled, highly-educated workforce. You would need an efficient transportation system. Perhaps you consider power supply and customer access. Taxes would be farther down the list.

Ultimately, it is the demand for goods and services that creates jobs. You can’t sell what nobody has the money to buy.

Perhaps it would be useful to compare Illinois’ taxes with surrounding states.

- Illinois Senate Bill 9 raised the State’s income tax rate from 3.75% to 4.95%. However, Illinois does not tax retirement income (pensions.)

- Indiana has a flat rate of 3.3% and taxes pensions.

- Iowa has a rate of 0.36% to 8.98% with those earning over $71,910 paying the highest rate; pensions are taxed.

- Missouri has a 1.5% to 6% rate, but if you make over $9253 you pay the highest rate; pensions are taxed.

- Wisconsin’s rates are 4% to7.25%, but only those earning over $252,150 pay the highest rate; pensions are taxed.

- Kentucky’s rate goes from 2% to 6% with those earning over $75,000 paying the highest rate.

Overall, Illinois is not overly taxed; it is taxed unfairly. The problem is, our Illinois Constitution does not allow for a progressive income tax. The philosophy of a progressive tax is that those who benefit the most, should pay the most tax. Illinois Democrats are hoping they can get our Constitution changed. They believe this would be a fairer tax and better for Illinois.