Peter Roff is a Senior Fellow at Frontiers of Freedom and a former U. S. News and World Report Contributing Editor, who appears regularly as a commentator on the One America News network.

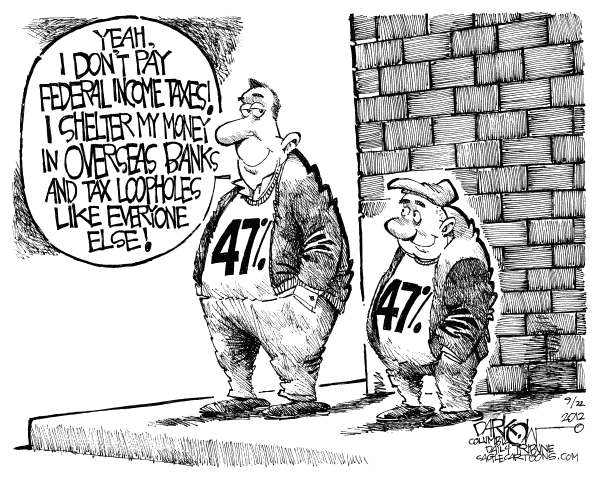

There’s nothing wrong with being wealthy. What matters is how one got to be that way. Far too often the economic elites and the political well-connected manage to exploit their power and status, to enrich themselves at the expense of the average taxpayer. It’s called “crony capitalism,” and there’s too much of it.

There’s nothing wrong with being wealthy. What matters is how one got to be that way. Far too often the economic elites and the political well-connected manage to exploit their power and status, to enrich themselves at the expense of the average taxpayer. It’s called “crony capitalism,” and there’s too much of it.

There are some people who describe these activities as being well within the confines of the free market. They’re not. The playing field is not level, people do not enjoy equality of opportunity, and, with a gaggle of lobbyists working on their behalf, these faux capitalists influence their cronies in Government, to twist regulations and laws to their advantage. As a result, policies designed to improve the well-being of the average American worker are bastardized into giveaways to big special interests, while members of the working class suffer.

There are countless examples of this trend. One of the most troubling involves (or rather devolves) from the 2008 financial crisis. Sensing an opportunity to line their own pockets while acting in consort with the Government, institutions throughout the financial sector began expanding the banking industry, offering new products, and providing lucrative home loans to more applicants than ever before.

These decisions culminated in a catastrophic financial collapse that threatened America’s entire economic substructure.

Washington decision-makers permitted the banks to make these decisions, because individuals and private businesses have an unquestionable right to take risks, so long as they’re ready to face the consequences that may come from them. Unfortunately, this is not where the story ends. The elites understood their unique position within the economy, assembled their lobbyists, and managed to negotiate the infamous $700 billion bank bailouts, in essence, paid for by the American taxpayer.

To this day, scenarios like this one occur on an all-too-regular basis. For a more current example, look to the 2017 tax reform package. Republicans and Democrats may argue over the efficacy of the corporate tax cuts or what constitutes one’s “fair share” of taxes, but everyone can agree the effort did simplify the tax code. While that isn’t necessarily a bad thing, the elite have seized on the law’s ambiguity, to pressure the government for special interest exemptions.

With the ink barely dry on the President’s signature, they started an earnest effort to bring loopholes back. They’ve mobilized lobbyists to resurrect a special interest insurance tax exemption, frequently referred to as the “Bermuda tax loophole, that provides foreign insurers an unfair competitive advantage over American companies. Through an insurance technique called “affiliate reinsurance,” foreign insurance companies can avoid billions of dollars in U. S. taxes, by transferring their assets to countries like Bermuda and Switzerland. This way, elites and foreign insurers get away with paying little-to-nothing in taxes, while making it even harder for American businesses to compete with them and stay afloat.

It was eliminated in 2017, but the big players who used to benefit want it back. They haven’t been successful so far in their efforts to jam it into some piece of must-pass legislation, but they haven’t given up. Lobbyists are not the problem. It’s the crony capitalists looking for special deals, that defeat the very purpose of tax reform.

Congress and the White House have an opportunity to put their foot down, by preventing the crony capitalists from putting special interest exemptions back into the tax code. America can take a step in the right direction toward limiting the elites’ corrupting influence over our economics and politics.

What is really regrettable is things like this happen every day. It might be a tall order to fight the elites on every inch of ground, but America needs corporate welfare reform now, just as much as it needed personal welfare reform like what was enacted in the 1990’s. These crony capitalist influences should not be permitted to corrode yet another facet of the American Dream.

In the United States, everyone deserves the opportunity to succeed, not just the privileged few.